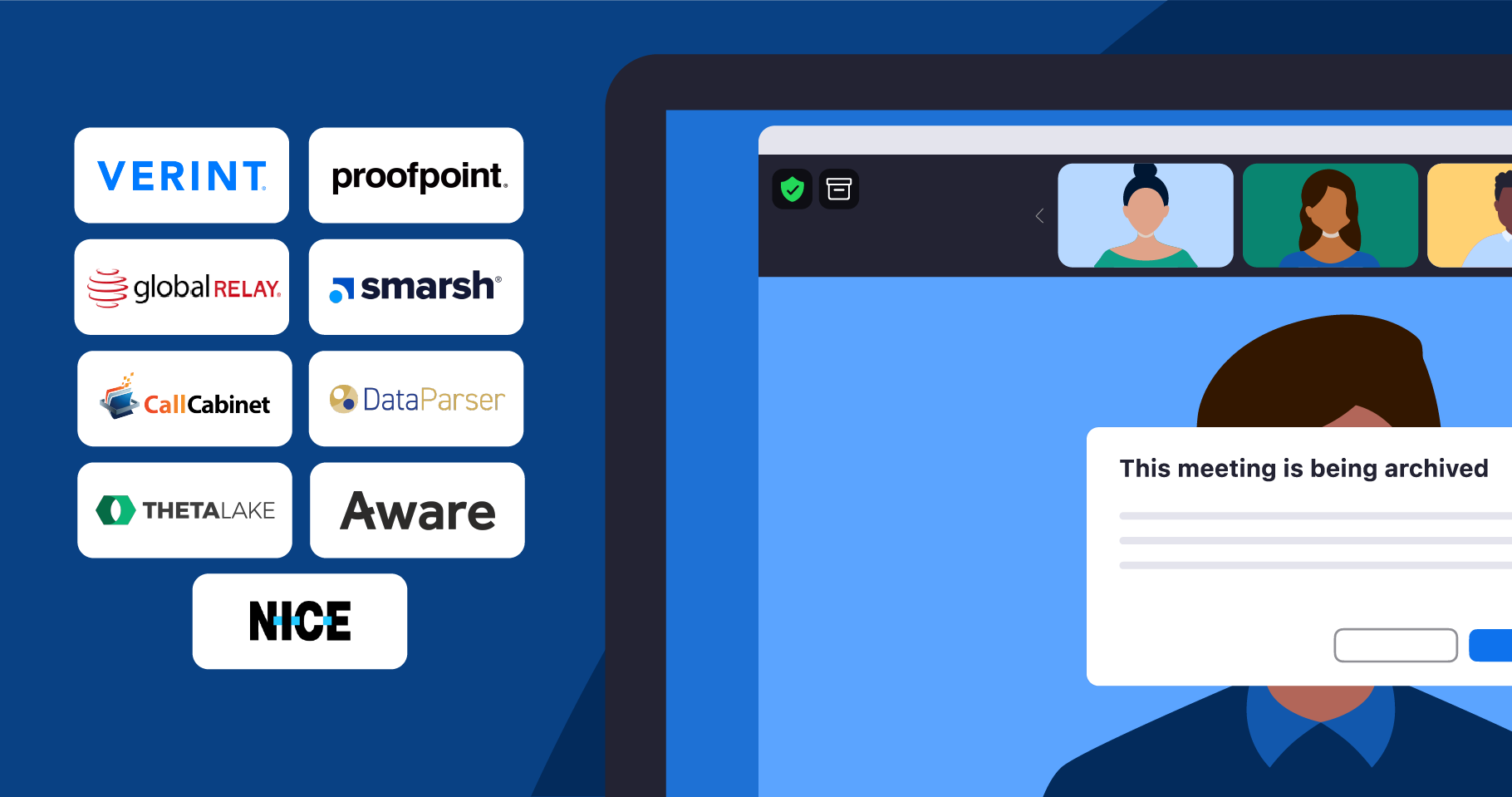

“Some of the gaps we ran into were really traditional — physical mail, hard copy, and print — and we’re never going back, we’re electronic now. We're a highly regulated industry and have to archive all our written words. So in June 2020, we implemented Zoom Team Chat with archiving capabilities across our entire employee base and now we’re rolling out Zoom Phone.” - Greg Driscoll, CIO at Penn Mutual

“At the beginning of COVID, people were tentative [about digital collaboration], financial reps didn't know the protocol for meeting with people. But all of the sudden our clients were demanding we become digital. Digital was faster — not only more convenient but desirable.” - Neal Sample, CIO at Northwestern Mutual

“Our customer-facing applications are changing dramatically. For someone to call in and rewrite their auto loan, it used to be passing documentation back and forth. Now, they can do the rewrite 100% digitally. And the rate of customer adoption is significant.” - Sathish Muthukrishnan, CIO at Ally

This shift toward full digital workflows extends beyond auto loans. Services like payday loans online now offer a similarly fast, remote experience, letting users handle the entire process from application to disbursement without ever visiting a physical branch.